Amazon vs. Walmart: Who will outshine the other in the next decade

Amazon is closing in and set to officially surpass Walmart as the leading retailer in the world should existing trends remain unchanged. By now, Doug McMillon and his board at Walmart have figured that their latest programs, regardless of the success of their new buying online and free Pickup in-store service, are not enough to hold off Amazon’s beating on their #1 ranking.

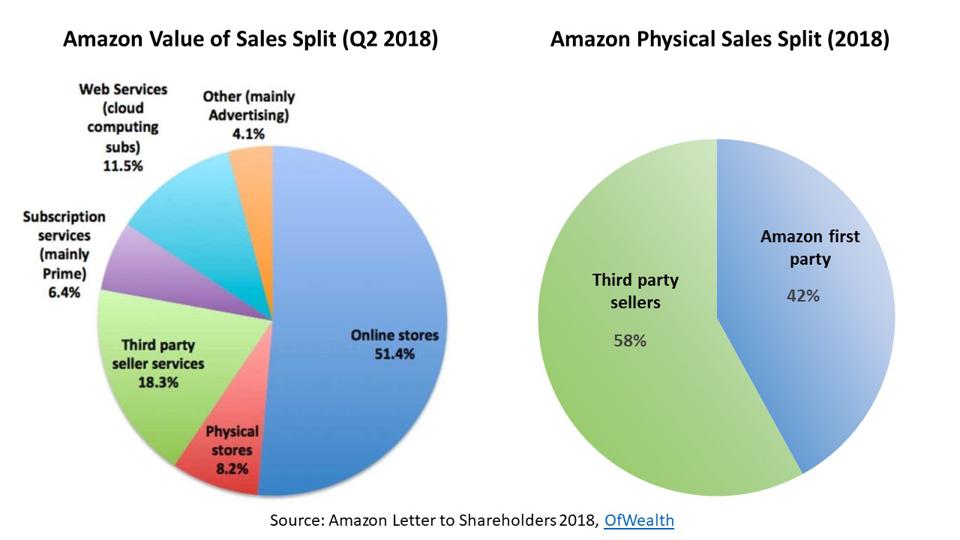

They have also evaluated that Amazon’s sales are vastly undervalued, and their impact is much more substantial than initially thought. Independent third-party sales already account for close to 60% of its physical sales (please see here) but only signify close to 20% of its overall sales (please see graph below). Amazon is only the seller of record for its first-party merchandise. In the case of third-party sales, it only registers expenses, fulfillment, and shipping fees. This means that close to 20% of Amazon’s sales are underrepresented.

This is not saying that Amazon is falsifying its sales. It is saying that accounting standards are not providing the full depiction of the size of Amazon. This author’s estimates are that the value of all the merchandise and services traded on Amazon’s stores and platform in 2019 is well over $600 billion (compared to average revenue estimates of $279 billion for Amazon and $520 billion for Walmart – see here). By this means, Amazon would have surpassed Walmart to become the largest company in the world in terms of sales; it sure looks like the Clash of Titans.

This is not saying that Amazon is falsifying its sales. It is saying that accounting standards are not providing the full depiction of the size of Amazon. This author’s estimates are that the value of all the merchandise and services traded on Amazon’s stores and platform in 2019 is well over $600 billion (compared to average revenue estimates of $279 billion for Amazon and $520 billion for Walmart – see here). By this means, Amazon would have surpassed Walmart to become the largest company in the world in terms of sales; it sure looks like the Clash of Titans.

Amazon vs Walmart 2020

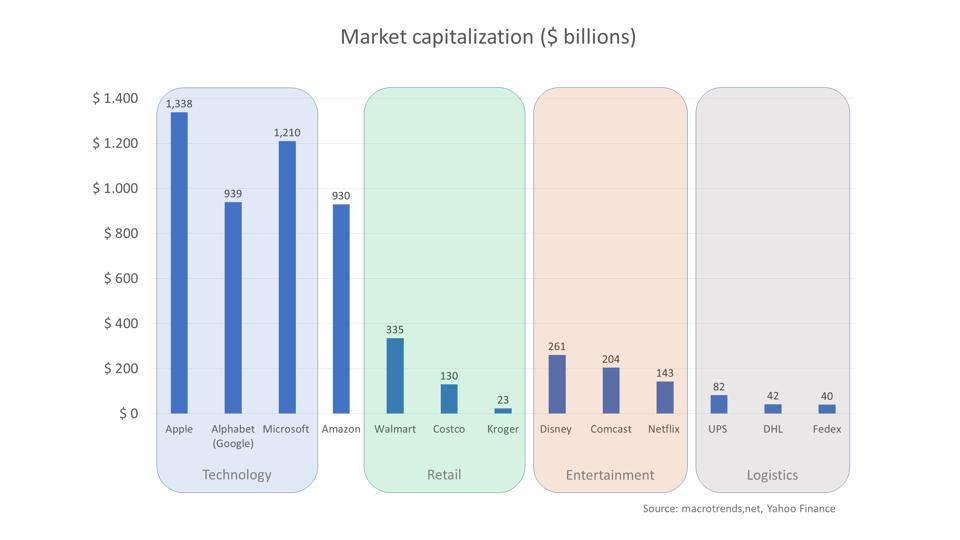

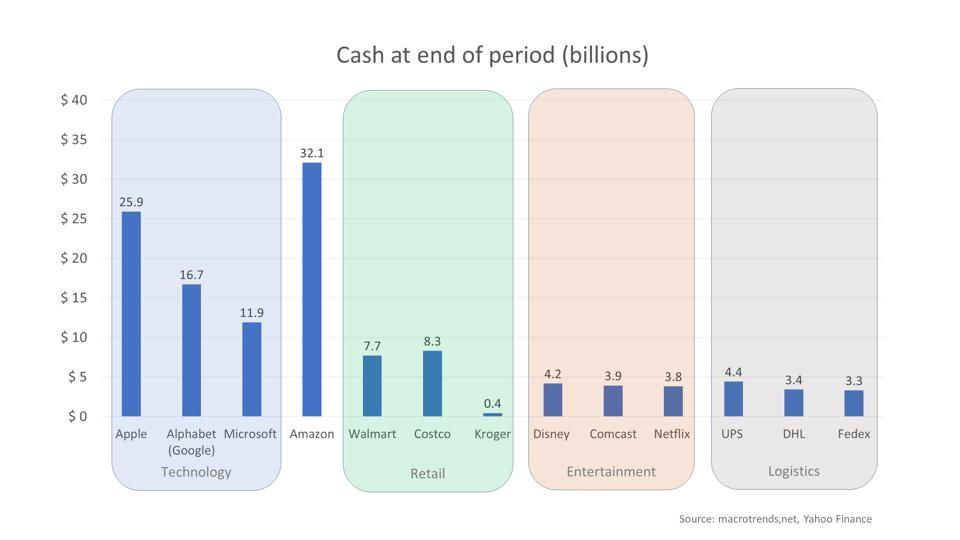

It is an uneven clash one in which Amazon vs Walmart revenue is unexpectedly the underdog. McMillon also has realized that Amazon has some mighty tools in its collection, notably, AWS, Prime, and advertising sales. They generate for Amazon an exceptional level of net profits of over 4% of total revenue and cash of $32 billion in 2018 compared to Walmart’s $8 billion. Walmart must neutralize these weapons if it wants to have a chance of winning and preserving its alpha status. But how! McMillon has some options ahead; let’s analyze each of them briefly.

Stay the course (60% chances of occurrence). Walmart will relocate on the very strategies that were successful and made it a success. It will extract efficiencies and savings from its existing supply chain, lower prices for low- and middle-income shoppers, and influence its network of stores for click & collect or (buy online, pickup in-store, BOPIS). Stop fancy and expensive acquisitions that have no synergy with Walmart’s core business model. This will keep Walmart on its growth trail but with lowered profitability levels. However, this will be deficient to stop Amazon from taking over the #1 rank in global sales, provided its higher rates of growth.

Stay the course (60% chances of occurrence). Walmart will relocate on the very strategies that were successful and made it a success. It will extract efficiencies and savings from its existing supply chain, lower prices for low- and middle-income shoppers, and influence its network of stores for click & collect or (buy online, pickup in-store, BOPIS). Stop fancy and expensive acquisitions that have no synergy with Walmart’s core business model. This will keep Walmart on its growth trail but with lowered profitability levels. However, this will be deficient to stop Amazon from taking over the #1 rank in global sales, provided its higher rates of growth.

Amazon vs Walmart Revenue

Face reality (20% chances of occurrence). Walmart may come to terms with the idea that its response to the Amazon threat was a case of too little, too late. It waited until the Amazon takeover of Whole Foods in 2017 to realize that Bezos was coming after them. Their reaction was largely positive; it may clearly be deficient to slow down Amazon’s amazing momentum.

The graphs in this article demonstrate Amazon is no more a retailer. As the “Market capitalization” and “Cash at the end of period” show, Amazon has more resemblances with the technology sector than with the remaining industries with which it competes which are retail, entertainment, and logistics.

Amazon vs Walmart revenue should find a partner that could effectively provide more firepower in its bout against Amazon. Its likely partners include a technology player and a logistics operator qualified of neutralizing Amazon’s logistics. Microsoft and Google are the most probable candidates if this situation plays out. Microsoft already has vital strategic negotiations in place with Walmart to drive its digital strategy and looks like the natural partner to deepen their engagement. With deep pockets and ready for a head-on clash with Amazon, Microsoft is the leading candidate.

The logistics companies, UPS and FedEx, must also feel they responded ‘too little, too late to Amazon’s threat. Opposite to Walmart, their fight is not for leadership but in fact for survival. With retail business, Amazon has so many revenue streams that it may very well start offering its fulfillment and logistic services at a loss. This would indeed force consolidation in the sector where FedEx looks like a weak competitor.

Even the Patriots crash (20% chances of occurrence)

A source of uncertainty for Amazon will unquestionably come from the government. Whoever wins the 2020 election, is likely to ask the Justice Department to take a hard look at large tech, amongst them, Amazon stands out for its skillful but legal tax avoidance. Amazon‘s taxes plus the bundling of services under Prime, weirdly reminiscent of Microsoft’s bundling of Explorer in Windows, which led to the downfall of Netscape, may create a wave of support for government intervention or regulation.

The decade forward will not see Walmart get surpassed without a good fight. Doug McMillon has demonstrated to be an effective, competent, and well-grounded leader at Walmart. Jeff Bezos is undeniably one of the most visionary business leaders of the 21st century. Their clash will decide the shape of retail in the next decade.